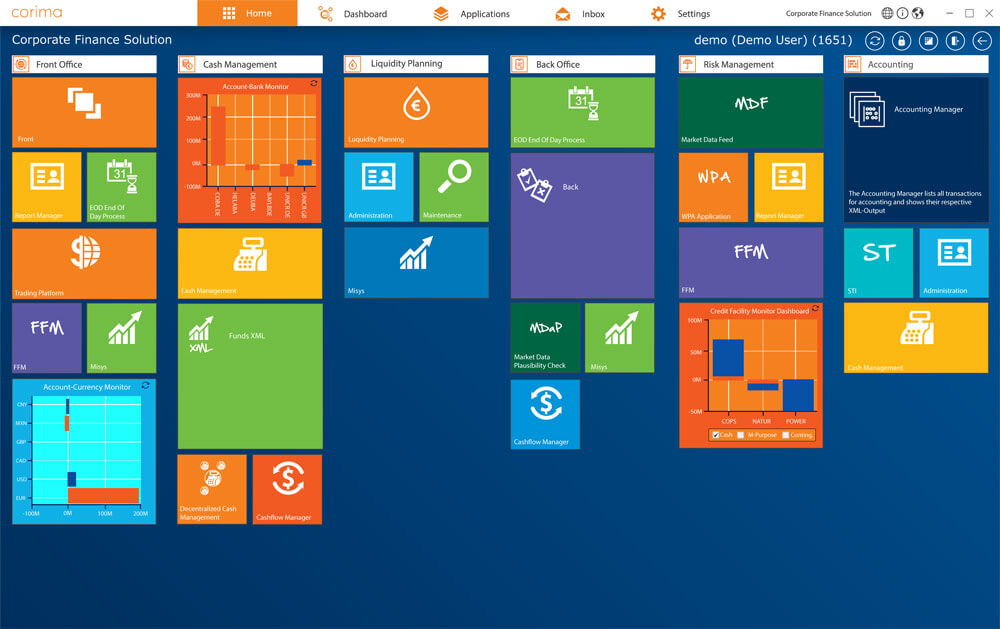

corima – die TMS-Lösung

für komplexe Anforderungen

Lösungen

cash management

Die cash management Funktionalität unterstützt Sie bei der Übernahme, Verwaltung und Anweisung von Zahlungen zur Optimierung des Zahlungsverkehrs im gesamten Unternehmen.

back office

Mit der back office Lösung wickeln Sie Ihre Finanzgeschäfte ab und steuern Ihren Treasury-Geschäfts-Workflow.

risk management

Die risk management Applikationen unterstützen Sie bei der Analyse und Steuerung Ihrer Finanzrisiken.

front office

In der front office Lösung können Sie schnell und flexibel ihre Finanzgeschäfte eingeben und erhalten einen Überblick über den aktuellen Stand ihrer Treasury-Positionen.

liquidity planning

Die Finanzstatus- und liquidity planning Applikationen ermöglichen Ihnen eine effiziente Darstellung und Planung Ihrer Liquiditätsposition.

accounting

Im accounting Modul können Sie Buchungskonzepte auf Grundlage nationaler und internationaler Vorgaben parallel umsetzen und in den gesamten Treasury-Prozess integrieren.

36. Finanzsymposium | 21.-23. Mai 2025 | Die COPS – Programmhighlights!

This year will be a memorable Finance Symposium. For the ...

WeiterlesenCOPS-Success-Story: 20 Jahre corima.PMS bei Wüstenrot

Wüstenrot & COPS – eine langjährige Partnerschaft Die österreichische Wüstenrot-Gruppe ...

WeiterlesenCOPS-Success-Story: Erfolgreiche Automatisierung des FX-Netting-Prozesses mit corima bei der voestalpine

Die voestalpine ist ein weltweit führender Stahl- und Technologiekonzern mit ...

Weiterlesen

Prozess

Applikationsprofile

Flexible Hinterlegung von Applikationsprofilen auf Gruppen- und Benutzer-Ebene

Integriertes Stammdatenmodell

Integriertes Stammdatenmodell für sämtliche Modulbereiche (von Front Office bis Liquiditätsplanung)

Berechtigungskonzept

Homogenes Berechtigungskonzept für alle Systemfunktionen

Daten und Berichtskonzept

Definiertes Output- Daten und Berichtskonzept

Systemoberflächen

Synchrones Konzept zur Gestaltung der Systemoberflächen

Einheitliches Schnittstellenkonzept

Einheitliches Schnittstellenkonzept zur Anbindung vor- und nachgelagerter Systeme

Abbildung/Steuerung von Treasury-Abläufen

Abbildung/Steuerung von Treasury-Abläufen durch Kombination von Systemmodulen

-

Thomas Eckhardt, Product Manager

Thomas Eckhardt, Product Manager

-

Robert Lukas, Partner – Software Engineering

Robert Lukas, Partner – Software Engineering

corima ist eine echte Innovation für Sie. Die hier zum Einsatz kommende Technologie bietet ein großes Spektrum an Lösungsmöglichkeiten und Variabilität in der Anwendung. Neben der Entwicklung von Innovationen und Lösungen für unsere Kunden arbeitet unser Entwicklerteam jeden Tag an der Stabilität, Zuverlässigkeit und Performance des Systems.

corima ist gleichermaßen Client-Server-Applikation und Applikation-Framework. Ihre besonderen Merkmale sind modernes Look&Feel sowie ein sich in der Entwicklung immer auf der Höhe der Zeit befindliches Front- und Backend. Zusätzlich beinhaltet sie eine Reihe von Standard-Schnittstellen zu externen Systemen inklusive Marktdatenanbietern, ERP-Systemen oder Handelsplattformen. Damit und mit der langjährigen Erfahrung unserer Spezialisten im Customizing unserer Lösungen wird corima die Schaltstelle Ihres Treasury.

Anwendungsfälle

- Front-to-Back Prozesse

- FX-Sicherung

- Buchhaltung

- Rohstoffe

- Marktdatenanbindung

- Request-for-Quote-Prozess

- Avale

- Darlehen

- Asset Management Prozesse

- Liquiditätsplanung

Passgenaue Strukturierung und Automatisierung Ihres Treasury-Prozesses

- Festlegung der relevanten Geschäftsartenbereiche (FX-Derivate, Geldhandel etc.)

- flexible Parametrisierung des unterliegenden Workflows (von der Geschäftseingabe bis zur Erzeugung von Zahlungsträgern)

- Parametrisierung des Geschäftseingabeprozesses (Festlegung von Eingabe-Informationen, Vergabe von Zugriffsrechten, etc.)

- Anbindung externer Trading-Plattformen (360T, etc.)

- Automatische Zuordnung von Zahlungs- und Buchungsinformationen (Back Office & Accounting)

- Matching von Geschäftsinformationen (inkl. Anbindung von Matching-Plattformen » Finastra)

Steuerung Ihres Währungsrisikos

- Definition der relevanten Sicherungs-Exposures (Cashflows aus Operativgeschäft und/oder Finanztransaktionen)

- Detaillierte Einbindung der Cashflows aus den operativen Prozessen in die Treasury-Abläufe (On- und Off-Balance-Positionen)

- Strukturierung und Zuordnung der Exposures aus Sicherungsgeschäften (Termingeschäfte, Optionen)

- Zusammenführung, Monitoring und Steuerung der FX-Risikoposition auf Real-Time-Basis

Detaillierter Aufbau von Accounting-Konzepten

- Durchgehende Trennung von Mandaten (Unterstützung einer zentralisierten Buchungssteuerung im Konzern)

- Parallele Buchung nach verschiedenen internationalen Buchungsvorgaben (HGB/BilMoG, IFRS, US-GAAP etc.)

- Buchung von Derivaten (FX, Zins, Rohstoff) unter Einbeziehung operativer Segment-Strukturen (Buchung auf Grundlage von Management-/Business-Einheiten)

- Umsetzung von IFRS-Buchungsvorgabe

– Bewertungs-Segmentierung gemäß IFRS

– Hedge Accounting gemäß IFRS (IAS 39 / IFRS 9)

– IFRS 7 / IFRS 13 - Aufbau von Darlehens-Buchhaltungskonzepten (inkl. Fremdwährungs-Bewertung)

Steuerung von Rohstoff Exposures, Handel und Sicherung

- Durchgreifende Gestaltung des Rohstoff-Sicherungsprozesses

- Übernahme und Mapping der Rohstoff-Exposures

- Segmentierung/Zuordnung der Commodity Derivate (Aufbau von Sicherungs-Portfolien)

- Übernahme von Markt- und Bewertungsdaten durch Direktanschluss von Kontrahenten (Aufbau eines Marktdaten-Pools)

- Aufbau eines Handels- und Abwicklungsprozesses für die Commodity Derivate

- Aufbau der Netto-Rohstoffposition

- Steuerung der Netto-Rohstoffposition

Integrativer Marktdatenprozess

- Bereitstellung eines Marktdatenpaketes (vwd/Infront)

- Standardisierte Schnittstellen zu den führenden Marktdatenanbietern (Reuters – Refinitiv / Bloomberg / Infront (vwd))

- Zentrale Verwaltung der Marktdaten

- Plausibilisierung von Marktdatenbewegungen

- Möglichkeit der Daten-Weiterverteilung an nachgelagerte Systeme (ERP, Controlling etc.)

Request-for-Quote (RfQ) – Geschäfte bündeln und Legal Entities anbinden

- Flexible Gestaltung von Workflows für den Eingabe- und Beantragungsprozesses

- Bedarfsgerechte Anbindung von Legal Entities, differenziert nach Geschäftsart

- Workflow-gestützte zentrale Überwachung, Genehmigung und Durchführung

- Unterstützende Dashboards und Notifications

- Anbindung diverser externer Handelsplattformen

- Anwendung von Nettingprozessen

- Automatische Verarbeitung der Geschäftsdaten in allen angeschlossenen Modulen (Accounting, Cash Management, Liquiditätsplanung, etc.)

Avale – Management mit Überblick

- Strukturierung des Antragsprozesses (3 Phasen):

1. Beantragung: Interne Anfrage von Tochtergesellschaften

2. Bearbeitung, Prüfung und Kontrolle von Anfragen

3. Weiterleitung des Avalauftrags an die Bank via Swift/pdf - Einfache und übersichtliche Bestandsverwaltung

- Kontrolle der Gebührenabrechnung inklusive

1. Auslastungs- und Bereitstellungsgebühren

2. Ausstellungsgebühren

3. Garantie Provisonen

4. Weitere - Internes und externes Linienmanagement

Darlehen nahezu jeder Komplexität erfassen, bearbeiten, planen und verbuchen

- Abbildung beliebiger Darlehensstrukturen

- Planung aller Cashflows über die Laufzeit und stetige Aktualisierung mit aktuellen Marktdaten

- Visualisierung des Zins- und Tilgungsplans

- Cashflow Gesamtübersicht

- Syndizierungen

- Volle Flexibilität bei der Anpassung der Darlehensstruktur während der gesamten Laufzeit

- Sicherung aller Vertragsdokumente

- Hinterlegung und Verwaltung von Covenants

- Automatische Durchleitung aller Buchungssätze zum Accounting

Abbildung integrierter Asset Management Prozesse

- Strukturierung von Order-Workflows

- Standardisierte Anbindung externer Systeme (FIX-Format)

- Kommunikation mit Depotbanken und Vermögensverwaltern via Swift

- Vollständige Integration der Asset Management-Workflows in den Abwicklungs- und Buchungsprozess

- Bestandsverwaltung auf Depot- und Portfolioebene

- Ermittlung von Performance- und Risiko-Kennzahlen

- Datenauswertung via Dashboards

Liquiditätsplanung – Alle Cashflows in einem System

- Direkte Planung

- Durchgängiges Rechtemanagement und Auditierung

- Abbildung beliebiger Planszenarien, Planungskategorien, -zeiträume und -ebenen

- Single Point of Truth

– Automatische Berücksichtigung sämtlicher Cashflows aus den angeschlossenen Modulen.

– Berücksichtigung aller automatisch generierten zukünftigen Cashflows - Simulation beliebiger Szenarien

- Konfigurierbarer Planungsprozess

- Direktes und zielgerichtetes Reporting

- Rollierende, währungsdifferenzierte Planung

corimamagazin

Sie möchten regelmäßig Updates zu Trends, Entwicklungen der Finanzbranche und unsere TMS-Themen? Dann abonnieren Sie gleich unser corimamagazin, das Sie via E-Mail über neue Beiträge und spannenden Neuerungen aus unserem Haus informiert.